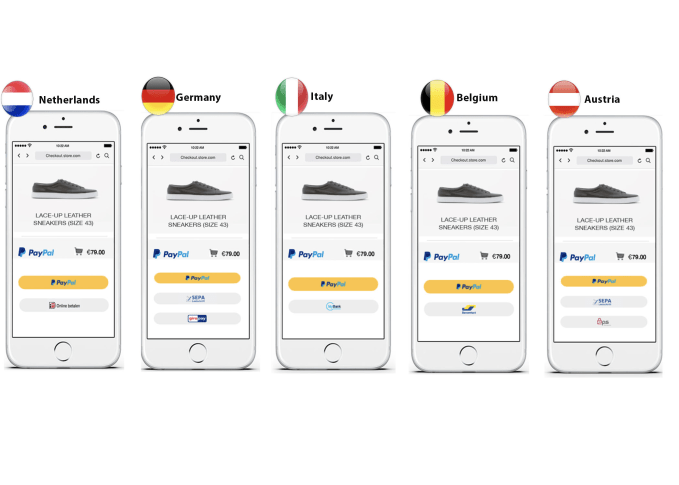

PayPal today is introducing new checkout technology for e-commerce sites that will dynamically present the most relevant payment method for each customer. That is, instead of retailers having to litter their checkout page with a variety of payment options, PayPal Checkout’s new “smart payment buttons” will update to display the right set of options for each customer in each geography.

That means retailers can more easily include alternative payment methods, like local wallets and country-specific options, alongside a PayPal button.

The company says it will begin with iDEAL in the Netherlands; Bancontact in Belgium; MyBank in Italy; Giropay in Germany; and EPS in Austria. These will arrive in a few weeks’ time. And it already has SEPA Direct Debit enabled for its customers in Germany.

The Smart Payment experience will also include access to PayPal’s own suite of checkout options, of course, including PayPal, Venmo, and PayPal Credit, as well as credit card payment options.

The new product will be One Touch-enabled, too – meaning online shoppers don’t have to keep logging in again with a username and password on each website they visit, following their initial PayPal sign-in.

To use PayPal Checkout with Smart Buttons, existing retailers will not have to reintegrate their sites with PayPal Checkout, the company tells us – they’ll only need to perform a small update. After doing so, they’ll have access to aggregated and anonymous insights about their online customers, including conversion rates, devices used, and a set of recommendations to help increase conversions and loyalty.

PayPal’s update comes at a time when it’s facing increased competition in online checkout from tech giants, Apple, Google and Amazon. With Safari on iOS devices and on the Mac, shoppers can pay with Apple Pay. Meanwhile, Google recently united all its payment tools under the Google Pay brand, which supports online retail checkout, too. And Amazon is simply sucking up ever more sales through its own One Click platform, often attached to its own payment cards or a customer’s Amazon Cash balance.

PayPal, however, touts its ability to convert at higher rates to ensure retailers continue to use its products. Specifically, it cites a comScore study that found its checkout product converted at 88.7 percent during checkout, or 82 percent higher than a checkout without PayPal.

Developer documentation for the new product is available today here.

from TechCrunch https://ift.tt/2tMh4i2

Post a Comment